3D Printer Gets Splashy Release, But It Won’t Change the World

3D printing start-up Carbon (formerly Carbon3D) was recently in the spotlight when it launched its first commercial offerings: a printer, dubbed the M1, and a range of resins for it targeted at prototyping and low-volume manufacturing applications. The M1 uses Carbon’s photopolymer printing process called “continuous liquid interface production” (Clip). It builds parts in a vat of photopolymer resin by shining UV light up through a window in the bottom to expose an entire layer of the part being printed at one time. The company claims its process is up to 100 times faster than other photopolymer printing processes like stereolithography (SLA) and photopolymer inkjet, and also results in materials with anisotropic mechanical properties.

Smart Materials: Looking for Problems to Solve

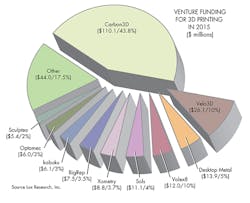

Last year, Carbon raised over $110 million in venture funding from investors that included Google and Autodesk. That was more than 40% of the year’s total VC funding across all 3D printing startups. The company attracts such attention because its core claims aim directly at two of 3D printing’s greatest weaknesses—speed and mechanical properties. Moreover, Carbon is also no slouch on cost, as it offers the M1 via a $40,000/year leasing model that enables much lower investment than buying a comparable system from competitors such as 3D Systems (which would cost more than $200,000 up front).

Perhaps more importantly, Carbon’s offering comes at a time when more companies than ever are ready to try 3D printing. Carbon’s pricing model offers them a relatively low-investment way to access an enterprise 3D printer. Barring any up-front issues with printer quality or availability (which I have no reason to suspect), Carbon can expect strong sales in the near term.

However, strong near-term sales and hype aren’t enough to produce an adequate return on a $110 million investment, and Carbon’s technology does not appear to be sufficiently game-changing to justify that sum.

The core advantages of the Carbon system are its speed and ability to build parts without the material layers characteristic of traditional 3D printed parts. The bonds between traditional layers greatly weaken printer parts, reducing their usefulness.

In 2013, Lux Researched called out mechanical performance and build speed as critical issues for 3D printing. So, had Carbon’s M1 come out in 2013, it would have been incredibly disruptive. However, major progress has been made in part strength and print speed in the past three years by groups such as Oak Ridge National Laboratory, Cosine Additive, and Arevo.

Carbon’s published mechanical performance figures, while good, are not disruptive or even best in class. In addition, the M1’s build chamber is relatively high, but quite narrow. This likely indicates that there is difficulty in rapidly flowing viscous resin under the part as printing occurs, which limits the possible size of the build chamber. A wider build chamber would make it much easier to penetrate the tooling market, the second largest and rapidly growing segment for 3D printing.

Moreover, while Carbon’s printer platform is priced to move, its materials are more expensive than alternative materials across nearly every class. On the low end, its prototyping resins are similar in cost to available photopolymers, but these must increasingly compete with thermoplastic polymers for FDM printers, which start at less than $40/kg. On the high end, its cyanate ester resin is more than four times the cost of the carbon fiber-filled polycarbonate used by Cosine Additive ($75/kg), a material that boasts similar mechanical properties and the ability to be used in objects as large as 1 m3. While Carbon’s system does have advantages, most notably in part-surface quality, there are a range of competitive options that can match it in performance at a lower cost.

What’s more, Carbon’s overall strategy is reminiscent of the razor/blade model that 3D printing majors have long employed. However, potential users of 3D printing for tooling and end parts increasingly demand control over the material formulations they use. Startups such as Cosine Additive give end users this freedom and leverage it as part of their value proposition. Carbon’s decision to restrict the materials used in its printer will further slow growth in functional prototyping and end-use applications. As a result, Carbon is best positioned to compete directly with incumbents such as 3D Systems and Stratasys for the prototyping market, rather than with other emerging startups looking to capture the faster-growing tooling and end-part manufacturing markets.

Looking for parts? Go to SourceESB.

About the Author

Anthony Vicari

Advanced Materials team member

Anthony Vicari is a member of the Advanced Materials team at Lux Research where he covers technological and market developments in emerging materials and manufacturing technologies, including composites, coatings, and metals. He also covers longer-term, potentially disruptive innovations such as metamaterials, smart materials, additive manufacturing, and graphene. Prior to joining Lux Research, Anthony was a R&D Scientist at InnovX Systems, developing improved elemental analysis for handheld x-ray fluorescence spectrometers. Anthony earned an M.S. in Materials Science and Engineering from Carnegie Mellon University, and a B.A. (magna cum laude) in Physics and Chemistry from Harvard University.