Steel is up to the AUTOMOTIVE CHALLENGE

|

Authored by: |

In the early 1900s, the dominant structural material used in cars and trucks was wood. By the 1920s, however, carmakers had switched to sheet steel and the industry never looked back. The decision to go with steel was an easy one. Steel made it possible to build stronger, stiffer, and more-durable bodies and chassis. More importantly, stamping and welding steel was adaptable to mass production and the assembly line. So, steel cars could be made in greater volumes and at lower cost.

For the last 100 years, the clear choice for automakers around the world has continued to be steel. And steel’s share of the average North American vehicle on the road today has been estimated to be nearly 60% by weight.

In fact, if one were to look at a coil of steel today headed for a car plant or a processor, it would look pretty much the same as it did decades ago. So how is it possible that one material can continue to satisfy the needs of such a dynamic industry for so long? And will it continue to meet those needs for another 100 years?

The anticorrosion challenge

Specifications for materials in vehicles are considerably more demanding than they were in the early days. What exactly has the steel industry done to satisfy these tough demands?

One good example involves corrosion. In the 1970s, automotive sheet steel was simply cold rolled, primed, painted, and put on the road. Corrosion resistance wasn’t very good. By the early 1980s, however, carmakers decided it was time to eliminate rust failures in their vehicles. Ten years later, steelmakers had installed continuous electro and hot-dip galvanizing lines, and carmakers switched to two-sided galvanized steel for cars and light trucks. These steps improved the corrosion resistance of steel bodies so much that companies began offering corrosion-perforation warranties.

Rusted bodies soon become a distant memory.

What few people realize is that the steel industry made the changeover to galvanized sheet while still maintaining class-A surface requirements, not an easy task.

Car companies also invested in research to find out which zinc coatings suited their particular operations and upgraded paint shops with phosphate pretreatments and full body immersion electrophoretic coatings, or “e-coat” primers. These new painting processes force paint into the tiniest crevices and control film thickness.

To make things even more challenging, different car companies had different preferences. For example, Ford Motor Co. and General Motors required pure zinc surfaces and still do today. This requirement can be satisfied by electrogalvanizing or special exposed-quality hot-dip galvanizing. Meanwhile, Chrysler and many foreign carmakers rely on zinc-iron coatings, which can be made by electrogalvanizing or by producing galvaneal, an inline annealed galvanized steel, on hot dip lines. In spite of these differences, the North American steel industry partnered with its customers, invested in facilities, and developed new specifications for new steels that met both customer needs and mill capabilities

At the same time, the North American steel industry began shutting down older facilities and building new ones, including continuous casters and ladle metallurgy stations. These investments, coupled with the new coating lines, represented a firm commitment to improve steel performance in vehicles. These improvements let steel be made much more uniformly than it had been by ingot processes, and much more cost effectively.

This switch to new types of steel offers a clue as to why steel has been so resilient in the marketplace. Steel processing was changed to adapt to industry anticorrosion requirements. The technical efforts were enormous, but carmakers and steel companies worked together on the problem to find the best solution. And although the investment by the steel industry in the 1980s totaled billions of dollars, it was clearly an important reason why steel maintained its dominance in making cars and light trucks.

The quality challenge

In the 1990s and 2000s, vehicle quality became the primary goal of domestic carmakers. Good performance in quality surveys like the JD Power IQS (initial quality survey) became primary corporate goals. Steel companies were also affected by this new emphasis on quality.

For example, dimensional control — how well parts fit together — became an important factor in quality audits. Certain aspects of using steel were closely related to poor fit (and finish) such as variability in stamping and in the mechanical properties and surface quality of sheet steel. Common defects were over or underflush conditions at gaps where exposed body panel met, and irregular hems or panel edges. Investigations into the root causes of these dimensional defects determined that both steelmaking and stamping processes needed tighter controls.

The Auto/Steel Partnership (A/SP), formed in 1987 with the Big Three and North American sheet-steel producers, addressed the issue with several projects. For example, one major project, the Uniformity of Materials Study, lasted several years and evaluated hundreds of coils of steel from different heats and different mills. Each was thoroughly sampled and tested to determine property variations of specific grades. One of the findings from this study was that variations in steel were found to have dramatically decreased over the course of the study. Much of the decrease was attributed to the enormous investment in high-tech processing equipment that made steels more uniform in chemistry, thickness, shape, and thermal history. These included continuous casters, vacuum degassers, computer-controlled rolling mills, and continuous annealing and galvanizing lines.

Two additional studies, the Stamping Process Control Study and the 2 Millimeter Program, demonstrated the importance of tight controls in stamping operations. Automakers learned that variables like binder force, cushion pressure, draw-bead condition, and blank placement (also called gauging) could be controlled to address problems with fit and finish.

Just as they did in the case of corrosion, the steel and automotive industries got together and improved the quality of vehicles made with steel.

The safety challenge

From 1990 to 2010, regulations governing vehicle crashworthiness increased dramatically. At the same time, The Dept. of Transportation’s National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS) introduced more crash test during this time than in any other period in history.

That’s also when the federal government, through the Dept. of Energy, introduced a program that clearly threatened steel’s role in cars and trucks. The project, called Partnership for a New Generation of Vehicles (PNGV), made research money available to develop technologies for lightweight fuel-efficient vehicles. The program stressed low-density materials such as carbon fiber, magnesium, and aluminum. No funds went to research into steel. This put the steel industry in the awkward position of having car companies, their customers, studying how to eliminate steel from their products while at the same time working with these same customers to make sure their vehicle could pass tougher crash tests.

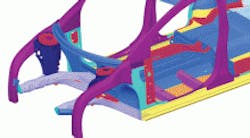

The steel industry solved the crash-test challenge with high-strength steels. However, these steel grades were limited when it came to forming. To improve the effectiveness of high-strength steels became the goal of the Ultra-Light Steel Auto Body program (ULSAB). In this project, 33 steel companies from around the world worked to find out if steel could be competitive against low-density alternatives. Turns out that effective use of steel could compete with low-density materials, thanks to advanced high-strength steel (AHSS), including dual-phase and transformation-induced-plasticity steels (both containing mixtures of hard and soft phases). In fact, more parts could be made out of high-strength steel and body weight trimmed by up 25%, all with no cost increases and no sacrifice in safety or structural stiffness.

After ULSAB, car companies began using more and more AHSS because they were structurally more efficient. They let these companies increase vehicle strength and energy absorption and pass a battery of increasingly tough crash tests. In most cases, better crashworthiness involved no increase in mass. In fact, there was often a reduction in mass.

The fuel-economy challenge

The next challenge facing steel may be the greatest challenge yet: fuel economy. New CAFE regulations, left in their current form, will essentially double the fuel economy of light-duty vehicles by 2025. There has never been anything close to this level of mandated reductions in fuel consumption.

Once again, the steel industry is challenged.

It is expected that car companies will need to employ a considerable array of new technologies, including turbocharging, stop-start, electrification, biofuels, diesels, advanced transmissions, and more. It is also likely that car companies will put a high premium on mass reduction. Clearly, companies that make or supply low-density material are eager to take a big slice out of long-standing steel applications.

But the steel industry has been preparing for several years for this challenge. A project called FutureSteelVehicle (FSV), for example, was completed last May. It builds on the success of ULSAB.

In FSV, the best steel designs are applied to the latest electrified vehicles including battery-powered, plug-ins, and fuel-cell cars. Fortunately, over time, AHSS steels have been developed that are even stronger and more formable. There are also more manufacturing and design processes that can put that strength exactly where it’s needed. The result: new designs and technologies that do not add costs while maintaining structural integrity and safety. In fact, technologies that were established in the FSV project open the door for new steel grades, processes, and design tools, all leading to steel structures like we have never seen before.

So steel has survived many years in the auto industry and will survive into the future, As before, the steel industry stands ready to partner with car companies to overcome the tough fuel-economy challenges ahead. Our collaborative history should give confidence to automakers and components manufacturers that steel has a bright future.

|

Two decades of new crash tests

At least 11 new crash tests were established between 1990 and 2012, and steel helped car companies pass each one. While those set up by the National Highway Tra c Safety Administration (NHTSA) and called Federal Motor Vehicle Safety Standards (FMVSS) are federally mandated, those conducted by the Insurance Institute for Highway Safety (IIHS) are not legally required. But auto companies strive to pass IIHS tests because the Institute makes its results public. |