This file type includes high-resolution graphics and schematics when applicable.

It’s that time of year when everyone, Machine Design included, is going to tell you what you can expect to happen over the next year or later. It may be hard to differentiate the hype from that which is based on sound advice, though. Often times, incremental products or innovations are difficult to track, and sometimes end up being more marketing than truth. Whether you plan on investing, trying to stay competitive, or are simply interested in what’s next, determining an accurate technology forecast is possible if you focus on several key factors discussed here.

Qualitative vs. Quantitative Information

To formulate an accurate forecast, you must first have accurate information. Data generally comes in two forms—qualitative and quantitative. Engineers might jump right to the quantitative numbers and statistics, but Melissa Schilling, professor of strategy at NYU, points out, “There are many ways that quantitative data can be manipulated or misread. There are other strategic concerns for project investment.

“For example, when sales are up on a product, it is tempting to reinvest in the same factors that made the product successful. However, those factors might be generating diminishing returns—you need to think about where the big opportunities for improvement that customers will value are,” she says. “This is one of the areas where qualitative information might generate more accurate ideas about what will happen in the market in the future.”

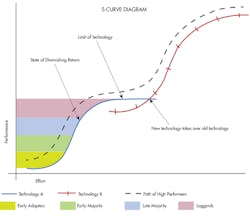

A diminishing return is illustrated in the S-curve diagram. It’s a sigmoid function on a graph that looks like an elongated “S”-like curve. This indicates that, initially, improving a product is difficult because it’s not well understood. Then, as it becomes better understood, less effort is needed to increase its performance. However, many technologies eventually reach a limit where effort and investment yield smaller performance gains. In other words, it enters a state of diminishing returns.

Furthermore, certain dimensions of improvement might have more payoff for customers than others. Some companies have learned the hard way that data provided from, say, an S-curve diagram might explain why, when quantitative numbers look good, it may not be wise to invest more into a type of technology.

“For example, Sony invested in improving their technology of Super Audio CD at a time when they believed customers cared about ever-increasing fidelity,” says Schilling. “Unfortunately, we were already nearly at the limits of human hearing in terms of audio fidelity, so the payoff to increasing fidelity wasn’t very big. While Super Audio CD and HD Audio were competing to be the highest fidelity audio formats, the MP3 format offered customers something they valued more—portability—and wiped Super Audio and HD Audio off the map.”

Sony is still around, but it’s no longer the same company from years past. Another example is Kodak and its innovative process for developing film. The company was extremely invested in chemical photography, developed tunnel vision, and despite inventing the first digital camera in 1975, didn’t make the jump to the new digital technology. Qualitative information can help pinpoint a diminishing return and be used as a red flag for any products based on that technology.

Ray Zinn, retired CEO of Micrel adds, “Understanding product cycles is the key to spotting trends. I know from experience that product cycles in the semiconductor industry tend to be around five years, give or take a year or so. By knowing when that product cycle started, you can easily determine whether your company is facing the beginning or the end of that product cycle.”

Understanding a technology’s S-curve and where it’s currently located on that curve is crucial: It will help you forecast if the next year or two will continue to reap and expand current technology incrementally, or if a different technology is getting ready to disrupt it and take over.

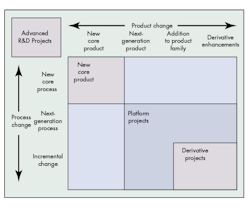

To clarify, not all technology is disruptive. A new feature added to current technology or new machines added into a family of products are considered derivative projects or incremental technologies. Disruptive technology tends to be the next generation of technology that will provide a new platform for incremental innovations to stand on. Also, disruptive technology normally signifies a need for new equipment, such as, for example, the switch from VHS to DVD.

Incentives and Abilities

Everyone wants to know which technology will win, and forecasting entails the consideration of many factors; even natural resources must be analyzed. Green and sustainable technology has increased and, according to Dr. Alberto Maria Sacchi, CEO of the Meccano Group, it will continue to grow due to the simple fact that natural resources are limited, and with a growing population, green technologies will be an important focus.

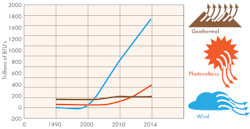

Schilling adds, “The type of green technology firms invest in is strongly influenced by their existing capabilities. For example, analyzing the performance improvement in several renewable energies, a team and I found that geothermal was offering the highest current efficiency and the greatest improvement per dollar of investment. However, we hadn’t even heard of this technology until we did this research. It wasn’t in the news. This is where qualitative reasoning and watching where incentives lay can help collect information for an accurate forecast.

“Firms that already use silicon (e.g., computer firms) or electronics are more interested in solar photovoltaics, which also use silicon and are based on electronics,” continues Schilling. “Firms that build dynamos and turbines (e.g., Siemens and GE) gravitate toward wind power, which is based on the same technology. However, geothermal is based on land survey, drilling, and pumping, and the companies that have this knowledge and the resources to tap this market are oil companies. Oil, however, is still profitable. There isn’t much incentive for these companies to expand geothermal technologies.”

With no incentive, there’s little to no motivation. But even if a company wanted to promote a new technology, it still needs the ability. New technologies can be expensive to integrate into an existing company.

For instance, in the automotive industry, Ford invested $1 billion into its Dearborn Stamping and assembly plant to make an aluminum intensive F-150. U.S. Steel invested $500 million to upgrade its production to make new advanced high-strength steels. While the benefits and technology are there, the cost to make the switch can impede a technology’s expansion.

Danny Schaeffler, President of Engineering Quality Solutions says, “Just think of the volumes necessary to justify the $500 million investment for a product that sells for about $1 per pound.” Few companies would have this kind of capital and ability.

Flexibility is important because it better enables a company to move quickly to a new technology. Capital still plays a large role in flexibility, making it possible to invest in the necessary infrastructure to gain a competitive edge. For example, the new Carbon 3D technology could take a portion of the stereolithography 3D printing market, but how do we know? When big companies like Ford and Autodesk backed Carbon 3D, it was apparent the technology offered value and was not going to disappear anytime soon.

Backing companies with capital can give new technologies the boost they need. However, a larger company can be resistant to change, or have high overhead that can stifle new innovations. It’s imperative to watch out for acquisitions and mergers that form a mutually beneficial partnership. Without proper management, even the greatest technologies will fail.

Adoption Rate

A fast adoption rate sounds great, but some technologies are like a bottle rocket—they take off and expire quickly. These technologies might have a large marketing budget and venture capitalists pumping tons of money into them, yet might not generate long-term returns. Some of these bottle-rocket types of technologies are simply inflated incremental innovations that benefit from extra marketing, but don’t have staying power.

To keep from following the wrong technology, look at the factors driving the adoption rate (again more qualitative and quantitative information). Most disruptive or breakthrough technologies with staying power will be tested rigorously, and they will progress at a controlled rate that’s inflated by market value—not hype.

Another problem often faced by new technologies when entering the market revolves around trust. The old technology has a tested foundation that’s comfortable. New technology requires a shift that can provoke lots of resistance. Open- and closed-source strategies play a large role in the adoption rate of new technology. Determining what strategy is better can be difficult, though.

“Closed source wins more often than open source, because a technology often needs a ‘guardian’ that promotes it and helps to keep everyone pushing in the same direction,” says NYU’s Schilling. “Open technologies are cheap and easy for firms to adopt, but without anyone managing their development, they can become fragmented with lots of incompatible versions. Furthermore, no one has the incentive to invest large amounts of money or effort in their improvement. Instead, a hybrid technology can be better.”

Schilling goes on to say, “Android is a good example of a hybrid source. While Android does own intellectual property and manages its development, they allow others to use it. This strategy allows Android to hold the keys, but still enables others to develop the technology as long as they follow some rules. These strategies will become more important to watch in the industrial industry as software will play an ever more important role with the growth of IoT and ‘smart’ devices.”

Rockwell Automation is adopting a hybrid approach. Daniel De Young from Rockwell marketing development explains: “Rockwell’s Studio 5000 is open as it relates to enabling and integrating a wide array of not only Rockwell Automation products and technologies, but also third-party products. This is achieved by leveraging open standards such as common industrial protocol. A device must simply be available on one of these networks and provide a corresponding configuration file. In addition, devices that are available on most any other protocol can be integrated through collaboration with a number of our Encompass partners, which offer interfaces to these protocols.”

Market momentum can be another driver that affects the adoption rate. In the case of closed versus open technology, once a few large players in the market start using a particular software, hardware, etc., others may adopt the same technology in order to remain compatible, and that can lead to an exponential climb in the adoption rate.

Another major factor for the adoption of new technologies will be the effort and investment needed to implement the new technology—any new infrastructure, employee training, or even changes in customer behavior that are required to efficiently use it. On the other hand, the larger a utility gap with a technology (the degree to which it offers something much better than what existed before), the more willing customers will be to make the effort to adopt it, thus speeding up the adoption process.

Large Technology Movers

Gaining quality information about incentives, abilities, adoption rates, and dimensions that customers care about for a technology will help in formulating a more accurate forecast. More factors might be outside the company’s control, though. Finding skilled labor, suppliers, and government are other large drivers of technology that a company needs to navigate to make accurate decisions, and are necessary to consider for accurate forecasts.

Education, skills, and people who can do the work are often technology drivers. Some industries can’t find qualified people. The need for quality technical abilities is one of the drivers behind IoT and automation technology. In a forecast, knowing if the labor force that drives the technology needs a year or more as a learning curve for something new will be valuable information to consider when the technology starts to take off, if at all.

Supply chain and logistics also play a role with new technology. If a technology has a concentrated region that’s difficult to ship to or from, it can prove problematic. One technology benefiting from this is 3D printing. Some companies are investing in new types of additive manufacturing to eliminate or reduce supply-chain problems. However, 3D printing cannot solve all supply-chain problems, and it’s imperative that companies are able to ship their technology to where it’s intended, and be used in an appropriate time frame.

One of the companies succeeding at this is Rittal, which specializes in enclosures. It offers 48-hour delivery of its products. By leveraging local partners to customize modular enclosures and make alterations for customers, it’s possible to have a few strategic large distributors cover a vast area while maintaining competitive delivery times. In forecasting, supply chain and logistics can demonstrate the potential for quick growth, depending on how fast a company can move technology. A technology can grow slower, but not faster, than its ability to deliver.

In addition, technology-concentrated regions that can facilitate a global strategic structure to promote their products will find favor. “Cloud design facilitates offshoring,” says Zinn. “For now, the labor-rate differential is attractive, though coordinating the interaction between designers scattered around the globe is a challenge. But the Cloud will offer companies an opportunity to bring manufacturing back, to onshore their technology.”

Zinn adds, “Automation will also be a driver. By eliminating human activity—manpower—in manufacturing, the more sense onshoring will make. If the labor content of a product drops below 20%, it could cause companies to rethink offshoring their manufacturing.”

Supply chain and logistics will continue to be important, as onshoring could increase and grow technology-concentrated regions. Delivering a new technology on time for a competitive cost is just the first step to building confidence in a new technology.

Government regulation, whether in support of or against, regarding technologies, taxes, labor, and environmental concerns, has proven to be a large deciding factor in the success, failure, or geographic location preference of different technologies. The government will play a large role in onshoring.

“The question is if the government will get out of the way and let onshoring happen,” says Zinn. “These interrelated issues—labor, taxes, total cost of design and manufacturing—are what politicians should be debating most as they are the greatest impediments to reviving American manufacturing.”

Another key factor to consider is intellectual-property (IP) law. IP will play a large role in stifling or accelerating technology in its respective countries.